Micro Finance

YDD’s Soft Loan Program: YDD initiated a special micro financing program which is designed to support low-strata communities by providing a progressive soft loan.

Even as Indonesia’s economic infrastructure continues to develop, high unemployment rates remain a problem. Dian Desa recognizes that small business is an important component of sustainable development.

With support from the Swiss Development Cooperation (SDC), Dian Desa developed a microfinance scheme. This program provides soft loans to non-bankable groups — groups which, due to various reasons, cannot access the formal banking/financing system. After several successful loan cycles (usually two cycles), the successful borrowers are assisted in embarking into the formal banking system. In this way, YDD’s Micro Finance program combines both enabling and mainstreaming.

At present the micro finance program of YDD only operates in the Yogyakarta province. Highlights of its portfolio from the third quarter of 2008 are as follows:

- Total borrowers: 10,282

- Total outstanding borrowers: 5,414

- Total outstanding loans: $1,560,000 USD

- Total assets: $1,820,000 USD

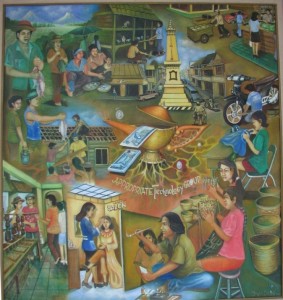

This painting depicts the broad range of small business and community enterprises that have succeeded with the help of the micro-finance division. The artist, Herupati, is a former client.